Top 7 Platforms to Buy Fractional Tokenized U.S. Stocks in 2025

December 5, 2025

The year 2025 marks a major surge in investing in tokenized U.S. stocks. The combination of fractional share ownership and blockchain tokenization is democratizing the stock market, enabling global investors to access U.S. blue-chip equities with small capital.

Concise Definition: Fractional Tokenized U.S. Stocks are digital representations of equity shares, allowing investors to own a fraction of a share rather than a whole unit, with transactions often recorded on a blockchain for enhanced security and transparency.

This article provides a transparent, data-driven guide to the top seven platforms that allow investors to buy fractional tokenized U.S. stocks online most effectively.

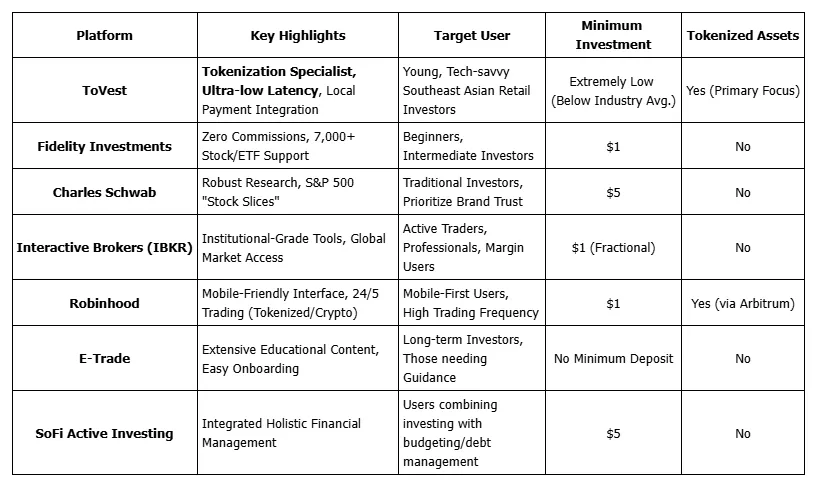

Quick Comparison Table: Best Fractional & Tokenized Stock Trading Platforms 2025

Top Platforms to Buy Fractional Tokenized U.S. Stocks

1. ToVest: The Leading Tokenization Bridge in Southeast Asia

ToVest positions itself as a leading fintech platform specializing in the tokenization and fast trading of Real World Assets (RWA), including fractional U.S. stocks.

- Core Value: ToVest focuses on bridging access for young, tech-savvy Southeast Asian retail investors to tokenized U.S. equities with ultra-low latency, transparent market data, and high security.

- Unique Selling Point: Highly accessible investment minimums (well below industry averages), robust educational support via ToVest Academy, and integration with local payment providers. ToVest is especially suitable for first-time investors or those with limited capital.

- Workflow Example: Users can buy U.S. stock fractions in USD or stablecoins, receive digital ownership tokens in their secure ToVest wallet, and track market prices and earnings with comprehensive charts and indicators.

2. Fidelity Investments: The Optimal Choice for Beginners

Fidelity stands out for its beginner-friendly approach, low fees, and excellent customer service.

- Feature: Offers “Stocks by the Slice,” allowing fractional buys for over 7,000 stocks and ETFs starting at just $1.

- Fees: Commission-free trades.

- Advantage: Renowned for its A+ BBB-rated customer support and advanced research tools, making it a top choice for new investors.

3. Charles Schwab: Reliable Traditional Broker

Schwab appeals to traditional investors seeking fractional shares of top U.S. companies using a reputable, regulated brokerage.

- Feature: Its "Stock Slices" feature allows users to buy fractional shares of up to 30 S&P 500 companies with as little as $5.

- Advantage: Strong research and tools, including market commentary and earnings reports from Reuters and Morningstar.

4. Interactive Brokers (IBKR): For Professional Active Traders

IBKR is the institutional-grade option tailored for active traders or professionals seeking advanced trading tools and global access.

- Feature: Supports fractional share trading via desktop TWS or IBKR Global Trader mobile apps, emphasizing its global reach.

- Advantage: Highlights low margin rates, extensive asset coverage, and deep analytics.

5. Robinhood: Leading Simplicity and Accessibility

Robinhood pioneered accessible, commission-free trading and strongly appeals to mobile-first users.

- Feature: Provides commission-free trading and a simple mobile interface.

- Advantage: Noted for 24/5 trading support for tokenized stocks and ETFs via Arbitrum layer-2, enhancing flexibility and liquidity.

6. E-Trade: Balancing Education and Accessibility

E-Trade blends accessibility for beginners with robust research and education resources for long-term investors.

- Feature: Supports fractional shares with no minimum deposit, offering an easy onboarding path.

- Advantage: Comprehensive educational content, investment tools, and community support structures.

7. SoFi Active Investing: Holistic Finance Integration

SoFi Active Investing is a user-centric platform integrating investing with broader financial tools for holistic money management.

- Feature: Ability to buy fractional shares starting at $5, blending investment with budgeting and debt management tools.

- Advantage: Appeals to users interested in managing investments alongside student loans, credit, and personal finance education.

Core Benefits: How Tokenization is Changing Stock Ownership

Tokenization is the conversion of traditional assets, such as stocks, into digital tokens stored and traded on a blockchain, improving transferability and transparency.

The advantages of owning Fractional Tokenized Stock include:

- Lower Barriers to Entry: Fractional shares let investors own a portion of high-value equity (like Meta or Costco) without buying a whole share.

- 24/7 Access & Liquidity: Tokenized shares allow for continuous trading and easier cross-platform transferability.

- New Use Cases: Enables the use of tokenized equities as collateral in DeFi lending protocols for extra yield.

Security and Compliance: Ensuring Safe Digital Investments

Compliance is the adherence to securities regulations (like the SEC in the U.S.), including proper platform registration or use of legal exemptions for token offerings.

Tokenized stocks are treated as securities. Leading platforms, such as ToVest, build trust by employing industry-leading security protocols (blockchain verification, secure storage) and strictly adhering to compliance standards, safeguarding investors' digital assets.