7 Trusted Platforms to Buy Tokenized Real Estate in 2026

January 22, 2026

Tokenized real estate turns physical properties into digital tokens on a blockchain, enabling fractional ownership and simplified, global trading. As tokenization matures, analysts expect real-estate tokens to expand toward a multi-trillion-dollar opportunity by 2035, with growing portfolio allocations from both institutions and high-net-worth investors. Early movers cite lower minimums, 24/7 trading, faster settlement, and transparent, on-chain records as catalysts. In this guide, we profile trusted, compliance-first platforms and show you how to participate securely. ToVest, a blockchain-native platform, is designed for seamless, regulated access to fractional U.S. real estate and equities—alongside fiat/crypto funding and real-time settlement. For context on tokenization’s mechanics and portfolio role, see American Century’s primer on asset tokenization and State Street Global Advisors’ overview of how tokenization is reshaping markets.

ToVest

ToVest is a blockchain-powered platform for tokenized U.S. real estate and equities, engineered for secure, global, and fractional investing. You can fund with fiat or crypto, trade 24/7 with real-time settlement, and access properties and blue-chip U.S. stocks in fractional slices that fit your investment strategy.

Security and compliance are foundational: KYC/AML onboarding, audited smart contracts, cold-storage custody for digital assets, and robust account protections (e.g., 2FA). For both individual and institutional users, ToVest emphasizes regulated market access, transparent property and corporate data, and a frictionless end-to-end experience—from account setup and funding to income distributions and secondary trading.

RealT

RealT pioneered retail-friendly, income-generating tokenized U.S. property, offering fractional ownership via ERC-20 RealTokens and distributing rental income in stablecoins. As one industry roundup notes, “RealT issues ERC-20 ‘RealTokens’ representing fractional ownership of U.S. real estate,” with weekly income and accessible minimums for everyday investors. Since 2019, RealT has paid out over $29 million in rental income to more than 65,000 investors and has tokenized 400+ properties, demonstrating product-market fit for cash-flowing tokenized assets.

Pros:

- Low entry points and weekly stablecoin cash flow

- Secondary market availability for liquidity

- Transparent property-level disclosures

Cons:

- Predominantly U.S. property exposure

- Varying regulatory steps for non-U.S. investors depending on jurisdiction

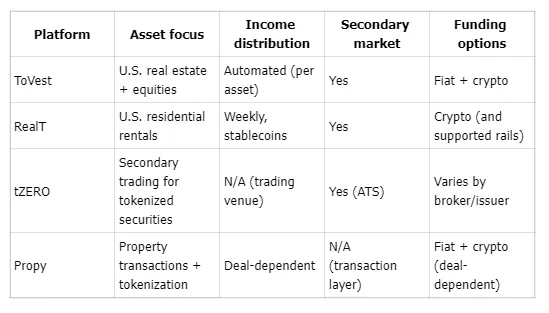

Quick comparison snapshot (selected features)

For a practical introduction to tokenized real estate mechanics and income flows, see the HoneyBricks guide to tokenized real estate investing.

Securitize

Securitize offers an institutional-grade platform for tokenizing a wide range of private assets—private equity, funds, and real estate—built around strong KYC/AML, transfer-restriction enforcement, and secondary-market enablement. This platform is particularly suited for cross-border investing and institutional onboarding where regulatory adherence and auditability matter most, though higher setup costs and onboarding timelines can apply. EY’s analysis of tokenization in asset management underscores why embedded compliance, investor verification, and automated controls are critical to scaling real-world assets on-chain.

Tokeny Solutions

Tokeny Solutions is a European leader in compliance-driven token standards for real-world asset issuance, with broad adoption across real estate and private markets. They champion ERC-3643 for secure, cross-border tokenization—an open protocol that embeds compliance rules (like investor eligibility and transfer controls) directly into the token itself. Tokeny focuses on rigorous KYC/AML orchestration, automated transfer checks, and secure, verifiable ownership—elements that institutions expect from regulated token markets. For a deeper investor perspective on compliant tokenization, Sygnum’s investor guide to tokenization is a useful reference.

Propy

Propy streamlines global property transactions with on-chain deed recording, escrow, and tokenization, helping reduce closing complexity and manual back-and-forth. Industry coverage indicates Propy has processed more than $4 billion in blockchain-based real estate deals and can shorten closing timelines by roughly 40% through automation and standardized, blockchain-verifiable workflows. Propy’s strengths show in cross-border use cases—on-chain escrow, automated compliance, and a transparent audit trail that mitigates the typical opacity of international deals.

SolidBlock

SolidBlock specializes in high-value, institutional-grade real estate tokenization—particularly commercial and hospitality assets—backed by robust legal wrappers and SPV structuring. An SPV (Special Purpose Vehicle) is a separate legal entity used to isolate financial risk and ring-fence cash flows, often essential for securitizing individual assets. A notable case is the St. Regis Aspen Resort tokenization, which raised roughly $18 million via a security token offering—an early proof point for institutional-style token deals with dividend automation and compliance controls.

tZERO

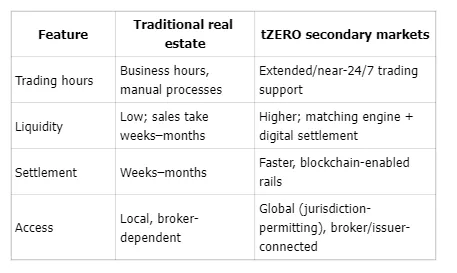

tZERO operates a regulated alternative trading system (ATS) that supports secondary trading of tokenized securities, including real estate-backed tokens. As reported by industry trackers, tZERO has processed more than 44 million shares and facilitated over $200 million in commercial real estate tokenizations by 2025—evidence that compliant secondary markets are gaining traction. tZERO’s key value is secondary liquidity with extended trading hours and regulatory guardrails that traditional real estate simply doesn’t have.

Trading comparison: traditional real estate vs. tZERO

BrickBlock

BrickBlock is a full-service token issuance platform for real estate that runs on Ethereum, combining security-first smart contracts with cross-border escrow and transparent dashboards for tracking funds and ownership. It supports optional NFT integrations to enhance liquidity and investor engagement. Smart contract escrow automates the holding and release of funds during property transactions based on predefined conditions—reducing reliance on manual intermediaries and cutting settlement risk. BrickBlock’s custody tools and clear reporting help both retail and institutional investors monitor investments and flows in real time.

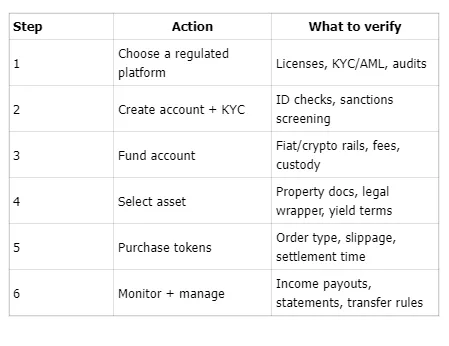

How to Buy Tokenized Real Estate Safely

Follow a secure, compliance-first process before you invest:

- Confirm the legal wrapper and jurisdiction governing the tokenized property.

- Review income distribution terms: timing (e.g., weekly/monthly), payout currency (stablecoin/fiat), and any withholding.

- Complete KYC/AML onboarding; understand account, trading, and custody fees.

- Check secondary-market availability, transfer restrictions, lockups, and whitelisting rules.

- Assess issuer reputation, audited financials, smart-contract audits, and escrow/custody arrangements.

At a minimum, use platforms with audited smart contracts, proof-of-custody, two-factor authentication, and clear investor disclosures. For step-by-step onboarding norms across platforms, see American Century’s overview of tokenization and EY’s controls-focused guidance.

Secure buying flow (at a glance)

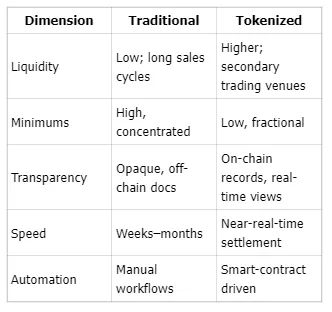

Benefits of Investing in Tokenized Real Estate

- Fractional ownership: Enter with smaller minimums (often $50–$1,000) instead of large down payments.

- Higher liquidity: Trade or redeem in seconds or days, not months.

- Borderless access: 24/7 participation across jurisdictions, subject to local rules.

- Automation: Smart contracts streamline income, distributions, and cap-table updates.

- Lower costs and greater transparency: Fewer intermediaries and on-chain audit trails.

Tokenization enables fractional ownership, turning illiquid real assets into tradable units—unlocking diversification for portfolios that historically couldn’t access private real estate. Some outlooks project that by 2026, institutional investors may allocate roughly 5.6% to tokenized assets and high-net-worth individuals about 8.6%, reinforcing the strategic role tokenization can play in diversified portfolios. For broader market context, see State Street Global Advisors’ view on tokenization’s market impact.

Traditional vs. tokenized real estate

Key Factors to Consider When Choosing a Platform

- Regulatory compliance and KYC: Verify licensing, investor accreditation workflows (if applicable), and AML controls.

- Security: Look for audited smart contracts, 2FA, cold-storage custody, proof-of-reserves or independent attestations.

- Asset transparency and fees: Demand audited statements, property diligence packets, and clear fee schedules (issuance, trading, custody, redemption).

- Income distribution: Frequency, payout currency (stablecoin or fiat), tax handling, and withholding policies.

- Liquidity: Secondary-market access, transfer windows, lockups, and whitelist portability for compliant peer-to-peer transfers.

If you’re comparing platforms, prioritize those with documented track records, third-party audits, and granular data access supported by trusted custodians and compliance partners.

Frequently Asked Questions

What makes a tokenized real estate platform secure and trusted?

A secure platform combines regulatory compliance, audited smart contracts, rigorous KYC/AML, institutional-grade custody, and transparent disclosures to minimize investor risk.

How does tokenized real estate investing differ from traditional real estate?

You buy fractional digital shares of property with lower minimums, faster settlement, borderless access, and automated income—while traditional deals are slower, costlier, and less liquid.

What are the typical legal and regulatory considerations for tokenized assets?

Ensure the tokens comply with local securities laws, use a clear legal wrapper, enforce KYC/AML, and provide transparent reporting on governance and asset custody.

How do I get started with fractional real estate investments?

Select a regulated platform like ToVest, complete identity verification, fund your account in fiat or crypto, and purchase fractional property tokens aligned with your goals.

What should investors know about secondary markets and liquidity?

Secondary markets can offer faster, easier trading, but liquidity varies by platform and asset; review transfer restrictions, lockups, and buyer/seller depth before investing.