7 Top Platforms to Trade On‑Chain US Stocks Globally in 2026

January 22, 2026

On‑chain US stocks—tokenized representations of traditional equities recorded on a blockchain—turn Wall Street into a 24/7, borderless market. By wrapping equity exposure into compliant digital tokens, platforms can offer instant, programmable settlement, stablecoin funding, and fractional ownership at dollar-level amounts, widening global access to U.S. markets (see Chainlink’s primer on tokenized equities). Momentum is real: ecosystem players continue to launch broader product sets, such as initiatives bringing 100+ tokenized U.S. stocks and ETFs on‑chain, signaling accelerating adoption. For investors outside the U.S., the best experience hinges on liquidity, compliance, and seamless stablecoin rails. This guide ranks seven leading platforms—spanning crypto‑native venues and top brokerages—and explains how each serves global investors looking for access, fractional ownership, stablecoin support, and strong security.

ToVest: Leading Global Access to Tokenized US Stocks

ToVest offers a unified, blockchain‑powered platform for individuals and institutions to access tokenized U.S. equities and other real‑world assets from virtually anywhere. Investors benefit from:

- 24/7 markets with real‑time, atomic settlement, ideal for cross‑border participation and hedging outside traditional trading hours.

- A robust fractional ownership model that enables precise position sizing, portfolio rebalancing, and single‑dollar exposure to premium names.

- Enterprise‑grade security: secure custody, audited smart contracts, two‑factor authentication, and continuous operational monitoring.

- Seamless multi‑currency participation via stablecoins (e.g., USDT) and major crypto (e.g., BTC), plus integrated fiat on‑ramps.

- Retail‑friendly workflows and institutional‑grade tooling, from streamlined onboarding to advanced order types and analytics.

By combining global access, liquidity partnerships, and compliance‑first infrastructure, ToVest effectively reduces the barriers that typically keep international investors on the sidelines.

BingX: Crypto Exchange with Broad Tokenized Tech Stocks

BingX lists a wide slate of tokenized U.S. technology names—frequently including NVIDIA, Apple, Microsoft, Amazon, Meta, Broadcom, Tesla, and Palantir—providing direct, crypto‑native access with stablecoin trading pairs. This allows global users to fund with USDT, search tokens, and trade with fewer banking hurdles. As with most on‑chain or exchange‑issued listings, liquidity and price discovery can differ from primary markets; spreads may be wider in off‑peak hours, and volumes vary by ticker and region. For active traders seeking convenient stablecoin settlement into U.S. tech exposure, BingX offers straightforward onboarding and recognizable symbols.

Binance: High Liquidity and Fast Execution for Tokenized Stocks

Binance is known for scale: its infrastructure has been cited as capable of processing roughly 1.4 million orders per second, which helps reduce slippage in fast markets—an important attribute for tokenized assets that can trade around the clock. The exchange’s global reach, deep order books, and feature‑rich environment (advanced charting, APIs, and derivatives) make it appealing to volume traders. However, access to specific products is jurisdiction‑dependent, and regulatory constraints may limit availability. For users in supported regions, Binance’s throughput and liquidity can materially improve execution quality and price stability on popular pairs.

OKX: Multi‑Chain Support and Fast Settlement for On‑Chain Stocks

OKX stands out for its Web3 tooling and multi‑chain operability, allowing sophisticated users to manage portfolios across networks with fast settlement and strong developer integrations. The platform also integrates the Bitcoin Lightning Network for rapid BTC transfers, reducing latency and fees when moving collateral or funding accounts—useful when pivoting between tokenized equities and other on‑chain opportunities. For traders who prize cross‑chain flexibility and quick settlement, OKX’s crypto‑native stack provides advantages that traditional broker rails can’t match.

Coinbase Advanced: Regulated Fiat On‑Ramp with Growing Tokenization

Coinbase Advanced offers a trusted, U.S.-based exchange experience with robust fiat rails and a compliance‑first approach. International and U.S. users can convert local currency into crypto and stablecoins with clear audit trails, then access a growing—but intentionally conservative—suite of tokenized offerings. Like most large retail platforms, periods of extreme volatility can stress systems; monitoring the Coinbase Status page helps users plan around peak‑time slowdowns. For investors who prioritize regulated fiat on‑ramps and account security, Coinbase provides a familiar path into on‑chain markets.

Interactive Brokers: Institutional Access and Fiat-Derivative Hedging

Interactive Brokers (IBKR) remains a gold standard for execution quality, global market access, and research depth. While direct, on‑chain tokenized equity support is still limited, IBKR’s strengths—global fiat custody, extensive market centers, and professional desktop platforms—make it a powerful complement for hedging or managing basis between tokenized exposure and traditional derivatives. Its SmartRouting technology and low options pricing—$0.65 per contract cited by independent reviewers—are useful benchmarks for evaluating the total cost of execution across platforms.

Charles Schwab / thinkorswim: Veteran Brokerage with Fractional Shares

Schwab’s integration of thinkorswim brings professional‑grade charting, options analytics, and advanced order management to a broad retail base. Fractional shares and low‑cost trading democratize access to U.S. equities, but the primary focus remains traditional markets rather than true on‑chain tokens. For sophisticated traders who want best‑in‑class tooling for core exposure—while dabbling in tokenized assets elsewhere—Schwab provides familiar support and education from a veteran brokerage.

Webull: Beginner-Friendly Trading with Community Features

Webull blends commission‑free stock and options trading with a community feed, sentiment indicators, and paper trading simulators—useful for first‑timers building confidence. It also offers micro‑futures, with contract fees as low as $0.25 cited by third‑party reviewers, and fractional shares to lower the barrier to entry. While Webull focuses on traditional equities versus fully on‑chain tokens, its UX and education tools can serve as a practical launchpad for investors planning to extend into tokenized markets later.

Key Factors to Consider When Choosing an On-Chain Trading Platform

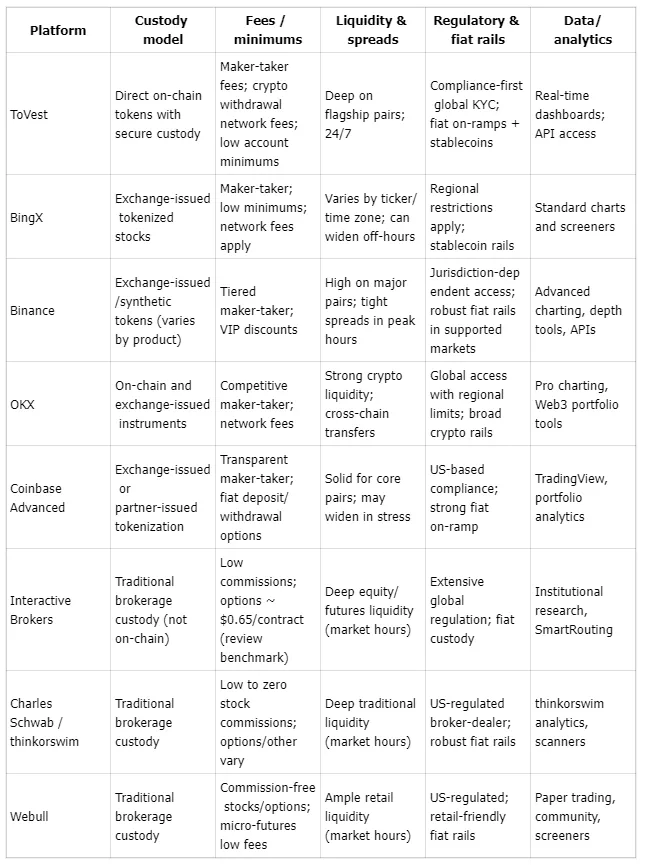

Selecting the right venue means balancing token custody, costs, liquidity quality, fiat rails, and analytics. Here’s a quick comparison:

How to Invest in On-Chain US Stocks Using Stablecoins

Stablecoins are cryptocurrencies pegged 1:1 to fiat (typically USD), enabling near‑instant, stable‑value transfers for trading.

Step‑by‑step:

- Create and verify your account on a chosen platform.

- Deposit stablecoins (USDT/USDC) or convert fiat/crypto into stablecoins via the platform’s exchange.

- Search for the tokenized U.S. stock you want and review its market data.

- Place your order using stablecoins; confirm maker‑taker and withdrawal fees.

- Choose custody: keep tokens in platform custody, transfer to a supported wallet, or rebalance into other assets.

ToVest streamlines this flow with instant stablecoin onboarding, real‑time settlement, and institutional‑grade custodial safeguards.

Advantages of Buying On-Chain Stocks for Global Investors

- 24/7 access and near‑instant settlement so you’re not bound by U.S. market hours.

- Stablecoin funding removes FX friction, enabling direct USD‑pegged trades from almost anywhere.

- Enterprise‑grade security and transparent custody, with on‑chain auditability and programmable controls.

- Fractional ownership makes premium stocks accessible in small amounts.

- (Definition) Fractional ownership lets you buy dollar‑amount slices—often $1–$10—breaking the full‑share barrier familiar in traditional markets.

Fractional Ownership of On-Chain Stocks for International Investors

Tokenization securely splits share exposure into smaller, transferable units, letting international investors buy single‑dollar slices of U.S. blue chips and diversify without large upfront capital. Because trades clear in stablecoins, you can adjust allocations in real time and reduce currency conversion overhead.

Key benefits:

- Accessible diversification with low capital.

- Real‑time rebalancing across sectors and factors.

- Reduced single‑stock and single‑currency concentration risk.

For perspective on the broader tokenization trend and growing listings, industry trackers continue to highlight expanding tokenized stock coverage across exchanges and venues.

Frequently asked questions

What are tokenized stocks and how do they work?

Tokenized stocks are blockchain-based assets that mirror traditional shares; they track the underlying price and can be traded 24/7 with programmable settlement.

What are the benefits of trading tokenized US stocks on-chain?

Investors get global access, fractional investing, fast settlement, and stablecoin funding for quick deposits and withdrawals.

Can international investors hold fractional shares on-chain?

Yes—fractional tokens allow small-dollar ownership of U.S. equities, improving affordability and diversification.

How do stablecoins enable 24/7 trading of tokenized stocks?

Stablecoins provide a dollar‑pegged medium of exchange, enabling instant, bank‑agnostic trading at any time.

What are the main risks associated with on-chain stock trading?

Key risks include liquidity variability, regulatory uncertainty, smart contract bugs, and wider spreads versus primary equity markets.