Tokenized Stocks vs. Traditional Shares: Risks, Returns, and Fees Compared

January 16, 2026

Tokenized stocks and traditional shares both offer exposure to the same underlying companies, but the methods for accessing, settling, and paying for that exposure are evolving rapidly. Tokenized stocks are blockchain-based representations of equities that enable fractional ownership, 24/7 trading, and near-instant (T+0) settlement, while traditional shares move through brokers and clearinghouses during fixed exchange hours with T+1/T+2 settlement. If your main question is which model offers better risks, returns, and fees, the short answer is: tokenization can add speed, flexibility, and global access—alongside new platform and technology risks—while traditional shares provide stronger legal rights and investor protections. Below, we compare the mechanics, costs, and risk profiles, and then show how to buy tokenized assets, including tokenized real estate and stocks, step by step.

Overview of Tokenized Stocks and Traditional Shares

Tokenized stocks are digital tokens on a blockchain designed to mirror the price and performance of an underlying equity. They typically support fractional investing, T+0 settlement, and programmable features enabled by smart contracts. Traditional shares are equity securities recorded in centralized systems, traded on regulated exchanges during set hours, and settled via brokers and clearinghouses on T+1/T+2 cycles. These differences change your user experience: tokenized markets operate continuously with rapid settlement, while traditional markets prioritize established protections and standardization, often sacrificing speed and flexibility, as outlined by industry overviews from OSL and others (see a concise breakdown in OSL’s explainer on core differences).

- Tokenized stock: A blockchain-based asset that provides direct or synthetic exposure to an equity’s economics, often available in fractions and tradable 24/7, with smart-contract settlement OSL breakdown and Gemini primer.

- Traditional share: A legal ownership interest in a company, governed by securities law, with trading and settlement supervised by centralized exchanges and regulators.

The rise of tokenized stocks and other blockchain-based assets aims to democratize access to high-priced U.S. equities through fractional ownership and always-on markets, widening participation across borders.

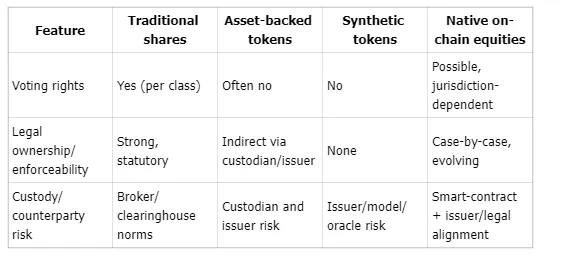

Legal Ownership and Investor Rights

Traditional shares confer recognized legal ownership, voting rights, and well-defined investor protections because they are squarely within established securities regimes. With tokenized assets, ownership and rights depend on design:

- Asset-backed tokens: Backed 1:1 by real shares held by a custodian; they often provide economic exposure without direct voting rights and introduce counterparty risk at the issuer or custodian layer, per a structural analysis of tokenized vs. traditional securities.

- Synthetic tokens: Track the share price via derivatives or oracles, but do not grant legal ownership; counterparty and model risks are higher.

- Native on-chain equities: Shares issued directly on-chain; legal enforceability depends on jurisdiction and corporate/securities law alignment.

Regulators continue to flag investor-protection gaps in tokenized stock offerings, making platform structure and jurisdiction decisive to your rights.

Key rights and risk features

Bottom line: legal clarity and statutory rights remain stronger with traditional equities; tokenized assets vary by model and platform.

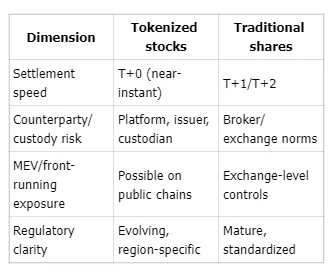

Risk Factors in Tokenized Stocks and Traditional Shares

Tokenized stocks introduce a distinct risk stack alongside market risk:

- Tokenized-specific risks: de-pegging (token price diverges from the underlying due to custodian/issuer problems), counterparty/issuer failure, liquidity mismatches, blockchain/tech vulnerabilities (smart-contract bugs, oracle errors, MEV/front-running), and regulatory uncertainty.

- Traditional-share risks: market volatility, occasional settlement delays, and broker outages—but generally stronger legal protections and standardized recourse.

As of December 2025, roughly 129,000 wallets held tokenized public stocks—evidence of rapid growth but still limited mainstream penetration.

Selected risk comparisons

Regulatory frameworks remain in flux and often platform- or jurisdiction-specific, which makes due diligence critical.

Returns Potential and Performance Considerations

Tokenized stocks are designed to track the prices of their underlying shares in real time. Because they trade 24/7 and can attract a global investor base, short-term volatility can be higher than in the underlying market during off-hours, even if long-run returns converge with the equity’s performance。 Fractional investing broadens access to high-priced names, helping investors build diversified portfolios without large minimums.

Market growth shows momentum: multiple trackers reported a sharp expansion of tokenized public equities in 2025, with aggregate value in the hundreds of millions and monthly transfers in the billions—significant, but still small next to traditional markets.

Typical return sources

- Tokenized stocks: underlying price appreciation; dividends (potentially distributed faster via smart contracts); occasional DeFi yields where tokens are accepted as collateral.

- Traditional shares: price appreciation; cash/stock dividends; buybacks.

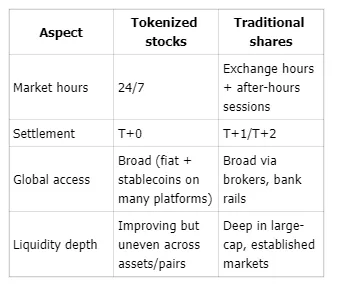

Liquidity and Market Access Differences

The biggest liquidity shift is temporal: tokenized stocks trade 24/7, while traditional exchanges operate on fixed hours. Always-on markets improve access but can see thinner order books and wider spreads when the underlying market is closed, leading to short-term price dislocations. Tokenization also expands participation globally—platforms increasingly support multi-currency funding, including stablecoins, which accelerates settlement and lowers friction for cross-border investors.

Even with rapid growth, tokenized equity volumes remain modest relative to global stock markets, contributing to wider spreads and higher execution costs in some pairs.

Access and liquidity snapshot

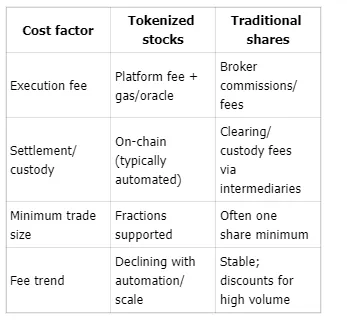

Fee Structures and Cost Implications

Tokenization can reduce transaction and custody costs by minimizing intermediaries—smart contracts automate settlement, dividends, and compliance workflows where supported. However, total cost of ownership will depend on the platform and the blockchain you use.

Potential fees to consider

- Tokenized: gas fees, oracle/data fees, minting/redemption charges, platform trading fees, withdrawal fees.

- Traditional: brokerage commissions, exchange/clearing fees, custody fees, FX conversion, and potential interest/borrowing costs associated with T+1/T+2.

Comparing costs and thresholds

Fractional trading on tokenized platforms lowers minimums, allowing investors to size positions precisely without purchasing whole shares.

How to Buy Tokenized Assets Including Real Estate and Stocks

Here’s a streamlined tokenized investment process—from platform selection to trade execution—for both tokenized real estate and tokenized stocks. Platforms like ToVest support low-latency execution, regulatory compliance, and multi-currency funding (fiat and stablecoins), making fractional investing accessible globally.

- Choose a regulated, audited platform that supports your target assets (stocks, real estate) and your region.

- Create an account: register email, set a strong password, enable 2FA.

- Complete KYC/AML: verify identity and address to unlock funding and trading.

- Fund your account via bank transfer, card, or stablecoins (USDT/USDC).

- Select the asset (e.g., a tokenized U.S. stock or a real estate token) and specify fractional or whole units.

- Review fees and slippage, then place a market or limit order.

- Confirm execution; tokenized assets typically settle T+0, updating balances instantly.

- Manage positions: set risk controls (stop-loss/take-profit), track P&L, and monitor on-chain proofs where available.

Choosing a Platform for Tokenized Investments

- Prioritize regulatory compliance, third-party audits, and proof-of-reserves to verify full collateralization and sound controls; investor-protection reviews remain a regulatory focus.

- Evaluate support for both tokenized real estate and tokenized stocks, global access, investment minimums, and 24/7 customer support.

- ToVest stands out: offering secure infrastructure, stablecoin support, risk management tools, and low-latency trading for global users.

Setting Up an Account and Completing Compliance

- Steps: sign up with email, create a strong password, enable 2FA, and complete KYC with government ID and proof of address.

- Digital KYC satisfies AML obligations and can be integrated with smart-contract workflows for jurisdiction-aware controls and auditability, streamlining onboarding on modern platforms.

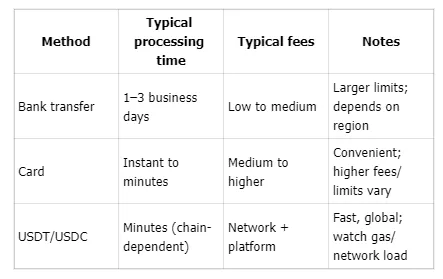

Funding Your Account with Fiat or Stablecoins

Common funding options

- Bank transfer (fiat)

- Card payments

- Stablecoin deposits (USDT/USDC)

Utilizing stablecoins can streamline processes by bypassing slower bank transfers, enhancing global accessibility. Processing times and minimums vary by platform.

Funding comparison

Placing Orders and Managing Tokenized Holdings

- Order flow: pick your asset, choose market/limit, set quantity (fractions allowed), and confirm.

- Settlement is typically T+0, reflecting balances immediately post-execution.

- Best practices: monitor real-time data, use stop-loss/take-profit, manage margin carefully, and review platform dashboards for on-chain proofs and audit trails where available.

Practical Considerations for Investors

Tokenized assets can complement, not replace, traditional holdings. Before allocating capital, evaluate:

- Token structure: asset-backed vs. synthetic vs. native on-chain

- Platform trust: regulatory posture, audits, proof-of-reserves

- Liquidity profile: depth, spreads, execution quality

- Legal regime: jurisdictional enforceability and disclosures

- Fees and minimums: total cost of ownership and fractional thresholds

Quick checklist

- Confirm platform audits and regulatory stance

- Assess liquidity and bid–ask spreads

- Verify custody, collateralization, and redemption process

- Analyze fee schedule and minimum trade sizes

Frequently Asked Questions

What are the main risks of investing in tokenized stocks compared to traditional shares?

Tokenized stocks add specific risks such as de-pegging and counterparty/issuer risks alongside market risk, while traditional shares benefit from stronger legal protections and mature oversight.

How do fees for tokenized stocks generally compare to traditional brokerage fees?

While automation can reduce some costs, tokenized trades may also include gas, oracle, and minting/redemption fees in addition to platform charges.

Can tokenized stocks deliver the same returns as traditional shares?

They aim to reflect the underlying equity’s returns, but performance may diverge in the short term due to liquidity, fees, and operational or regulatory frictions.

What should investors know about legal protections when buying tokenized assets?

Rights can vary by model and jurisdiction; tokens may not grant direct ownership or voting rights, so review the platform’s legal structure and disclosures carefully.

How does 24/7 trading impact liquidity and pricing for tokenized stocks?

It improves access but can also lead to thinner liquidity and wider spreads when the underlying markets are closed, potentially increasing short-term price variability..